Ask The SILC Group

The SILC Group is the online service which makes completing application forms for managed funds and financial products as easy as one, two, three.

Frequently asked questions

Beneficial Owners / Shareholders / Controlling Persons

To comply with AML/CTF Law the investor is required to disclose its beneficial owners. 'Beneficial owner' or 'Controlling person' means an individual who ultimately owns or controls, directly or indirectly, the Investor. 'Control' includes control as a result of, or by means of, a trust, agreements, arrangements, understandings and practices, whether or not having legal or equitable force and whether or not based on legal or equitable rights, and includes exercising and control through the capacity to determine decisions about financial and operating policies. 'Owns' means ownership, either directly or indirectly, of 25% or more of the Investor.

FATCA status

The most common status types as follows:

- Active NFFE (non-reportable account)

- Passive NFFE with controlling US persons (US reportable account)

- Passive NFFE with no controlling US persons (non-reportable)

- Non-Participating FFI (any payments to this account holder are reported

- Participating FFI (non-reportable)

- Deemed Compliant FFI (non-reportable)

- Exempt Beneficial Owner (non-reportable)

- Specified US Person (US reportable account)

Reportable accounts

These are accounts that the Fund Administrator will need to report annually to ATO/IRS. The Fund Administrator will flag these in the registry system and use them to produce a report compliant with ATO guidelines. The accounts that will be reported include:

- Any account held by or controlled by one or more US persons

- Any account held by a Nonparticipating FFI

US person

An account holder who is a US citizen or taxpayer. Includes US entities and other qualifying persons such as Green Card holders.

Specified US person

A US citizen or US resident for tax purposes, privately owned US Corporation or US Owned Foreign Entity.

FFI (Foreign financial institution)

- Depository institution – entity that accepts deposits in the ordinary course of a banking or similar business (banks, credit unions), or

- Custodial institution – entity that holds financial assets for the account of others as a substantial portion of its business (brokerages, custodians), or

- Investments entity – entity that is engaged (or holding itself out as being engaged) primarily in the business of investing, reinvesting, or trading in securities, partnership interests, commodities, or any interest (including a futures or forward contract or option) in such securities, partnership interests, or commodities (mutual funds, private equity funds, hedge funds).

Participating FFI

FFI that enters into an agreement with the IRS to undertake certain due diligence, withholding and reporting requirements for US account holders.

Nonparticipating FFI

Nonparticipating FFI is an entity that does not comply with FATCA and generally will not fall into any of the below categories:

- Compliant FFI (entity that complies with FATCA & generally able to provide GIIN); or

- Deemed-Compliant FFI; or

- Exempt beneficial owner

- Non-participating Financial Institutions are subject to 30% withholding tax on payments from sources within the US (e.g. income or redemption proceeds) and their accounts are reported to ATO/IRS.

NFFE (Non-financial foreign entity)

NFFE is any non-US entity that is not an FFI (Foreign financial institution).

Active NFFE

- NFFE where less than 50% of income is passive income (i.e. dividends, interest, annuities etc.) and less than 50% of its assets produce passive income;

- Entity’s stock is regularly traded on established securities market (e.g. entity listed on ASX) or affiliated group of such entity

- Entity organized in U.S. Territory and owned by its residents

- Foreign government

- International organization

- Foreign Central Bank of Issue

- Any other specifically identified class, including those posing a low risk of tax evasion, as determined by the IRS (e.g. start-up entities, entities in liquidation, not-for-profit entities etc.)

Passive NFFE

- not anActive NFFE or

- not a withholding foreign partnership or trust.

Deemed-compliant FFIs (Non-reporting FFI and exempt beneficial owners)

The following non-reporting entities are treated as exempt beneficial owners or deemed-compliant FFIs, as the case may be, and the following accounts are excluded from the definition of Financial Accounts:

- the Australian Government, State and local governments and local authorities and their wholly owned agencies or instrumentalities, including certain named entities;

- International, intergovernmental and supranational organisations;

- Reserve Bank of Australia and its subsidiaries;

- Superannuation funds (including self-managed super funds);

- Investment entity wholly owned by exempt beneficial owners (e.g. fund where all of its unitholders are superannuation funds);

- Financial institution with Australian client base (must satisfy all condition listed in paragraph III. A of Annex II of the IGA, including at least 98% of the US dollar value of all account balances must be held by Australian residents);

- Small local banks;

- Financial Institution that is not an Investment Entity with only Low-Value Accounts (i.e. with value of US$ 50,000 or less) and with total assets of no more than US$50 million;

- Qualified credit card issuer (with customer deposits of US$50,000 or less);

- Sponsored investment entity - an investment entity established in Australia that has a Sponsoring entity;

- Investment Manager and Investment Advisors;

- Certain Collective Investment Vehicles.

Translation to Australian currency

All amounts in US dollars will be translated to equivalent in Australian Dollars using and an exchange rate determined as of the last day of the calendar year preceding the year in which the balance is being determined (e.g. for balances as at 30 June 2014 exchange rate as at 31 December 2013 should be used).

Pre-existing individual accounts

Individual accounts with a balance not exceeding USD 50,000 as of 30 June 2014 are not required to be identified or reported.

Lower Value Individual Accounts

Individual accounts with a balance that exceeds USD 50,000 but not exceeding USD 1,000,000 as of 30 June 2014 are identifiable and reportable as lower value individual accounts.

High-Value Individual Accounts

Individual accounts with a balance that exceeds USD 1,000,000 as of 30 June 2014, or 31 December 2015 or any subsequent years are identifiable and reportable as high-value individual accounts.

The Foreign Account Tax Compliance Act (FATCA) was introduced in 2010 and is a United States regulatory requirement that aims to deter tax evasion by US taxpayers. From 1 July 2014 under FATCA, financial institutions (including managed investment funds) are required to identify investors that hold certain "financial accounts" and are US persons, or that are entities with substantial US owners.

Information on accounts and investments held by these investors must then be reported to the US Internal Revenue Service (IRS) via the Australian Taxation Office (ATO) in Australia.

FATCA self-certification must be completed by all investors to declare their US status except for regulated super funds (i.e. Self-Managed Superannuation Funds, APRA regulated super funds, government super funds or pooled superannuation trusts).

From July 1, 2017 the Common Reporting Standard, (CRS) a global standard for the collection and exchange of financial account information, applies in Australia. From that date, each time an application is made for a fund the investor will be required to self-certify their tax residency or tax status as part of the application process.

If the investor is a foreign tax resident, they are required to supply their Tax Idendification Number (TIN) or equivalent if they have one. Where the investor is an entity certain associated individuals, such as beneficial owners or controllers, will also be required to provide their tax status. This information is required to be reported to the ATO by the fund's Trustee or Responsible Entity for passing on to the relevant offshore tax authority.

If you would like more information on FATCA or the CRS, please contact your tax adviser or visit the ATO website.

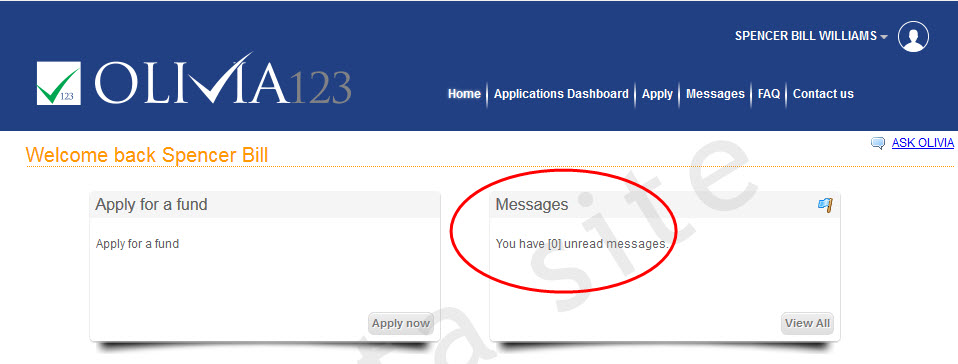

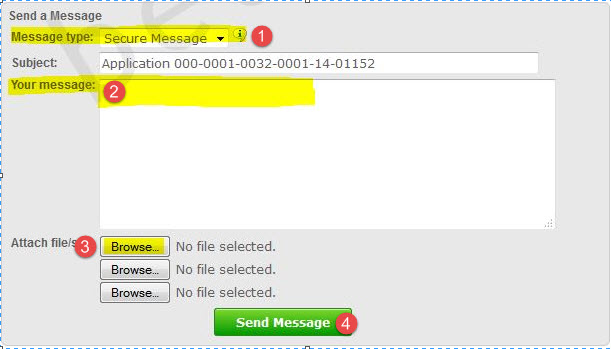

Messages may be sent between Investors and Fund Adminstrators via The SILC Group's internal message system.

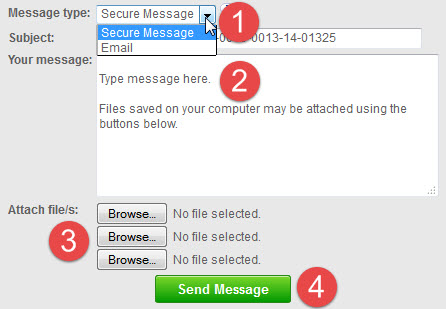

Messages may be sent via Olivia123's internal message system, or under Message Type there is a drop down option to send via email.

- Secure Message: will notify the recipient via email that there is a message to view - they must log into Olivia123 securely to view the message. Email: will send the message and any attached files via email. However, please note that email is not recognised as a secure medium and we do not suggest using email if any sensitive information is being supplied.

- Type your message here.

- Browse: to upload any documents that you wish to transmit. For example, Investors may send a copy of EFT or Direct Deposit payment receipt.

- When finished, select Send Message.

Read more here: Message System - sending messages

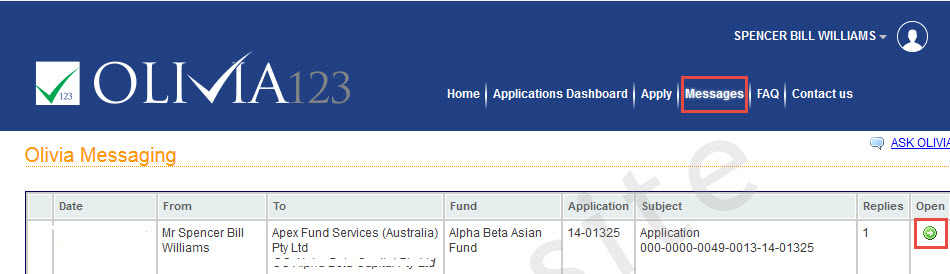

Investors and Fund Administrators will be notified of incoming messages via email and if sent via The SILC Group's message system, will be required to log in securely to view the message.

Unread messages will be marked with a red flag. To open, read and respond to the message, select the Open button.

Messages may be sent between Investors and Fund Administrators via The SILC Group's internal message system.

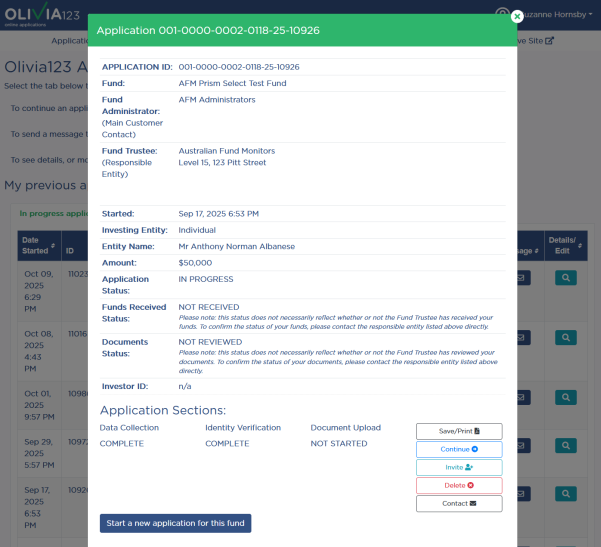

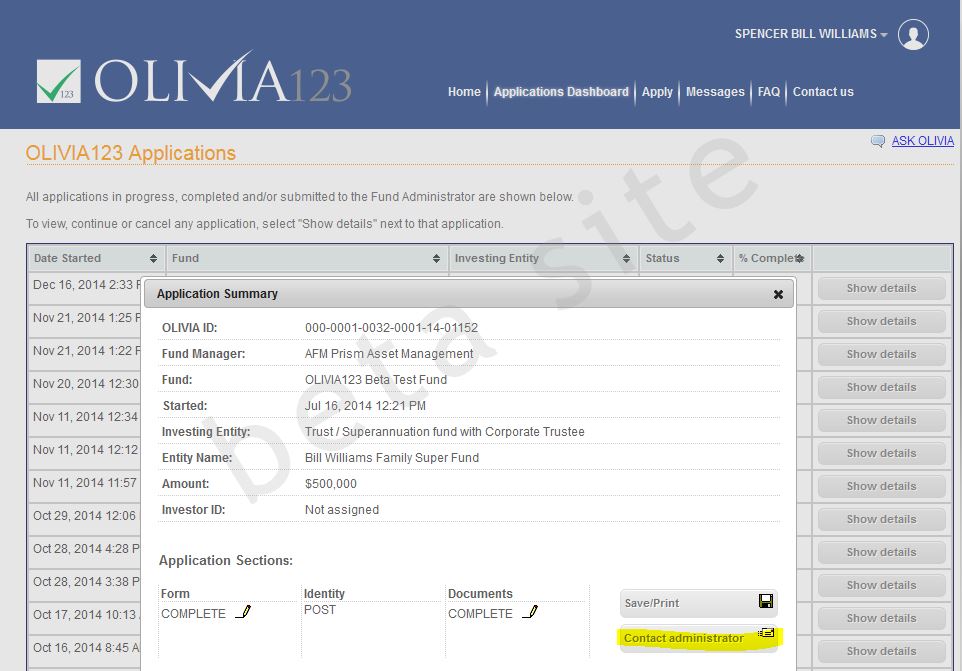

To initiate a message, go to the Applications Dashboard and select "Show Details" for the relevant application and then select the "Contact" button.

Messages may be sent via The SILC Group's internal message system, or under Message Type there is an drop down option to send via email.

- Secure Message: will notify the recipient via email that there is a message to view - they must log into The SILC Group securely to view the message. Email: will send the message and any attached files via email. However, please note that email is not recognised as a secure medium and we do not suggest using email if any sensitive information is being supplied.

- Type your message here.

- Browse: to upload any documents that you wish to transmit. For example, Investors may send a copy of EFT or Direct Deposit payment receipt.

- When finished, select Send Message.

Read more: Reading and responding to messages.

Politically exposed persons (PEPs)

To comply with AML/CTF Law we require you to disclose whether you are or have an association with a politically exposed person (PEP).

A PEP is an individual who holds a prominent public position or function in a Government body or an international organisation in Australia or overseas, such as a Head of State, or Head of a Country or Government, or a Government Minister, or equivalent senior politician. A PEP can also be an immediate family member of a person referred to above, including spouse, de-facto partner, child and a child’s spouse or a parent. A close associate of a PEP, i.e. any individual who is known to have joint beneficial ownership of a legal arrangement or entity is also considered to be a PEP.

Where you identify as, or have an association with a PEP, we may request additional information from you.

.

Source of Funds

As part of the Fund Manager’s or Responsible Entity’s obligations to ‘know their customer’ and to assess money laundering and terrorism financing risk under their AML/CTF program, the AML/CTF Law now requires them to ask about the Investor’s (and of the Investor’s beneficial owners) income and assets available for investment and the sources of funds, including their origin.

- The Data Collection module requires you to enter all information about the investing entity (names and addresses); the investment amount; and the method of payment.

- The system is "rules based" - you will only be asked for information relevant to your investor type, and some information must be completed before you can proceed to the next page.

- At each stage of the application, your data will be saved so that you may leave the application and return to it later from the Applications Dashboard.

- Proof of identity provides online identity verification. You will be asked to provide various types of identification (most commonly used are Drivers Licence or Passport) and your details will be checked against either State or Federal electoral roles.

Depending on your circumstances and your investor type (for instance individual or superannuation fund, and type of trustee) you might also be asked to provide certified copies of certain forms of identification (as outlined in the data collection module) and will be given the choice of uploading these documents to The SILC Group's secure server, or sending via post to the Fund's Administrator.

- You are then able to Submit your Application. You will be provided a Checklist of next steps which will provide a list of any additional documents required and payment instructions. Submitting your application automatically sends a message to the Fund's Administrator who can access it via the secure OLIVIA server for processing.

A US person is:

(a) Any natural person resident in the United States;

(b) Any partnership, limited liability company or corporation organised or incorporated under the laws of the United States;

(c) Any estate of which any executor or administrator is a US person;

(d) Any trust of which any trustee is a US person;

(e) Any agency or branch of a non-United States entity located in the United States;

(f) Any non-discretionary account or similar account (other than an estate or trust) held by a dealer or other fiduciary for the benefit of a US person;

(g) Any discretionary account similar account (other than an estate or trust) held by a dealer or other fiduciary organised, incorporated, or (if an individual) resident in the United States; and Any partnership or corporation if:

(ii) formed by a US person principally for the purpose of investing in securities not registered under the US Securities Act, unless it is organised or incorporated, and owned, by “accredited investors” (as defined in Rule 501 (a) under the US Securities Act) who are not natural persons, estates or trusts. Notwithstanding the foregoing clauses (a) through

(h):

(i) any discretionary account or similar account (other than an estate or trust) held for the benefit or account of a non-US person by a dealer or other professional fiduciary organised, incorporated, or (if an individual) resident in the United States shall not be deemed to be a “US person”;

(ii) any estate of which any professional fiduciary acting as executor or administrator is a US person shall not be deemed to be a “US person” if:

(A) an executor or administrator of the estate who is not a US person has sole or shared investment discretion with respect to the assets of the estate; and

(B) the estate is governed by laws other than those of the United States;

(iii) any trust of which any professional fiduciary acting as trustee is a US person shall not be deemed to be a “US person” if a trustee who is not a US person has sole or shared investment discretion with respect to the trust assets, and no beneficiary of the trust (and no settlor if the trust is revocable) is a US person;

(iv) an employee benefit plan established and administered in accordance with

(A) the laws of a countryother than the United States and

(B) the customary practices and documentation of such country, shall not be deemed to be a “US person”; and

(v) any agency or branch of a US person located outside the United States shall not be deemed a “US, person” if: the agency or branch

(A) operates for valid business reasons,

(B) is engaged in the business or insurance or banking, and

(C) is subject to substantive insurance or banking regulation, in the jurisdiction where located. Furthermore, none of the International Monetary Fund, the International Bank for Reconstruction and Development, the Inter-American Development Bank, the Asian Development Bank, the African Development Bank, the United Nations, or their agencies, affiliates and pension plans, or any other similar international organisation, or its agencies, affiliates and pension plans, shall be deemed to be a “US person”.

Web Browser

The SILC Group is optimised for Google Chrome, Firefox and Safari. It is highly recommended that you use one of these browsers to prevent unexpected behaviour from unsupported browsers.

We suggest that you download and install Google Chrome, Safari or Firefox for a more satisfying web browsing experience.

As an investment advisor you strive to provide your clients that added level of service. Often that means you, or your staff end up filling in application forms on their behalf. OK, it’s part of the service which many sophisticated investors expect, but there’s often a good reason they choose not to complete the forms themselves.

It’s tedious, confusing and all too often they make mistakes, tick the wrong box, or omit required information which delays the investment application.

The SILC Group has been designed and developed to make the task of completing managed fund application forms faster, simpler and more efficient. And let’s face it, whether you’re completing a managed fund application form for the first time or the fortieth, it’s probably not your most enjoyable task.

There are multiple sections of the form to complete, and frequently the information asked for is repeated. Depending on who the actual investor is (individual, partnership, company or trust) different information is required. And the increased requirements for an investor’s proof of identity to satisfy anti money laundering (AML) legislation just complicates the process further.

Sadly there’s no one there to tell you if you have made a mistake, omitted to tick a vital box, or attach the correct documents. As a result far too many paper application forms “fail” to be processed in time for cut-off dates, while application monies sit idly in the custodian’s bank account not earning interest.

The SILC Group changes all that.

Once you have logged into a secure server using the latest in two step authentication you can complete the application online. The SILC Group uses a rules based process to make sure you only see, and complete the sections and questions of the application form that are relevant – whatever the investor type.

The SILC Group’s rules also guide you through the application process, eliminating errors and omissions wherever possible.

The SILC Group has an optional AML identity module which allows the investor to be verified against the electoral roll, and with their consent other identity documents, such as driving licence to be confirmed online in real time. Scanned copies of documents can be uploaded and attached to the application form, or if required copied and sent by post.

The completed application form can be saved online and sent electronically, and printed for your and the client’s records. Alternatively if required all documents can be signed and sent as a hard copy with additional and verified documents.

The SILC Group makes completing online application forms as easy as one, two, three.

Investors using The SILC Group should assess whether it is appropriate in light of their own individual circumstances before acting upon the advice or information.

The SILC Group has been designed and developed to make the task of applying for managed funds faster, simpler and less frustrating for investors.

Whether you are completing a managed fund application form for the first time or the fortieth, it always seems to be a tedious and confusing process.

There are multiple sections of the paper form to complete, and frequently the information asked for is repeated. Depending on the type of investor (individual, partnership, company or trust) different information is required. The increased requirements for an investor’s proof of identity to satisfy anti money laundering (AML) legislation complicates the process further.

Sadly there’s no one there to tell you if you have made a mistake, omitted to tick a vital box, or have attached the correct documents. As a result many paper application forms aren't processed in time for cut-off dates, while your application money sits idly in a custodian’s bank account not earning interest.

The SILC Group changes all that. Once you have logged into a secure server you can complete the application online. The SILC Group uses a rules based process to make sure you only see and complete the relevant sections and questions of the application form – whatever your investor type.

The SILC Group’s rules also guide you through the application process, eliminating errors and omissions wherever possible.

The SILC Group has an optional AML proof of identity module which allows your address to be verified against the electoral roll and other identity documents, such as your driving licence, to be confirmed online in real time. Scanned copies of documents can be uploaded with your application form or if required, copied, signed and sent by post.

Completed application forms can be saved and sent electronically, and printed for your records. If required, documents can be signed and sent as a hard copy with additional or certified copies.

The SILC Group makes completing online application forms as easy as one, two, three.

Investors using The SILC Group should assess whether it is appropriate in light of their own individual circumstances before acting upon the advice or information.

As an "agent" of the Investor you are able to fill out and submit applications on behalf of the investor. Agents may be any of the following:

- Financial Advisors

- A person with Power of Attorney

- A person with Corporate Authority

All agents will be required to provide proof of authority with the Investor's application.

For example:

- Investment Management Agreement

- Power of Attorney

- Other written evidence of the authorisation to act on behalf of the Investing Entity.

The definition of a Qualified Purchaser, in accordance with Section 2(a)(51) of the US Investment Company Act.

A Qualified Purchaser means:

- A person with not less than US$5 million in investments

- A company that is owned by close family members, with not less than US$5 million in investments

- A trust, not formed for the purpose of making the investment, with not less than US$5 million in investments

- An investment manager with not less than US$25 million under management

- A company with not less than US$5 million in investments

Two factor Authentication is an added layer of security within The SILC Group.

It is a process with two stages to verify the identity of a person trying to access The SILC Group which requires:

- Something the user knows (e.g., login password); and

- Something the user has (e.g., email address, mobile phone).

Each factor must be validated for authentication to occur.

The first step is to log in using the username and password. This makes use of the knowledge factor.

The second step requires an email address or mobile phone number which makes use of the possession factor. A security token will be sent to the email address or mobile phone number, which will need to be entered into The SILC Group in order to proceed.

The purpose of using two-factor authentication is to prove that users are a real person and not a robot, reduce the risk of identity theft, online fraud and phishing scams.

All Investors will need to register with The SILC Group prior to filling out their first application form. This can be done by providing your name and an active email address, where you will be sent an activation email.

When you complete each application via The SILC Group, as a secondary security measure, you will need to provide your email address or mobile phone number to receive a security code and enter that code to The SILC Group to proceed through the form. This two-factor identification process is to deter unwanted access to The SILC Group.

The person registering for The SILC Group and completing the form does not have to be the applicant. You might be a financial advisor, corporate representative, have a power of attorney or another representative of the investing entity.

The Corporations Act 2001 defines a Wholesale and/or Sophisticated Investor as a type of investor who is deemed to have sufficient investing experience and knowledge to weigh the risks and merits of an investment opportunity.

Net worth and income restrictions must be met before a person can be classified a Sophisticated Investor. The distinction makes an investor eligible as a Wholesale and/or Sophisticated client.

Typically, a Sophisticated Investor in Australia must meet one of the following requirements:

1. Has net assets of more than A$2,500,000

2. Has income of at least A$250,000 per annum over the last two financial years

3. Is investing $500,000 or more into the opportunity

Any party investing less than $500,000 will be required to provide proof of the above by providing a certificate from a qualified accountant. Examples of certificates are shown here.

Paying for your Investment

Payment of your investment can be made in 4 ways:

- Cheque

- Electronic Funds Transfer (EFT)

- Bank Deposit via your local bank branch

- SWIFT (for International funds transfer)

Relevant details for all options will be provided on the checklist at the conclusion of the application form.

Please ensure that you have read and understood the offer documents, and in particular the terms and conditions surrounding the deadlines for accepting applications and cleared funds. The Responsible Entity does not accept responsibility for any loss caused as a result of non-receipt, missed deadlines or non-acceptance of any application or cleared funds.

Bank Account Details

All applications must include details for a current bank account, in the name of the Investor, for distributions and redemption payments. The Fund Administrators may ask for proof of bank account details in the form of a bank statement.

If paying for your Investment via EFT or Bank Deposit, you must send a copy of the payment receipt to the Fund Administrator. This may be done via our internal message system.

Investors/Advisors who wish to change their banking details can do so by completing the CHANGE BANK DETAILS FORM and sending to the Fund Administrator via the The SILC Group Applications Dashboard.

How? Just follow these steps:

- Download the CHANGE BANK DETAILS FORM, complete the relevant details and have all parties sign as required.

- In the upcoming Version 2.0 to be released in April 2015 the change bank details process will be automated but for the moment we appreciate your patience in completing and uploading the form.

- From the HOME menu, select "Applications Dashboard"

- Select "Show Details" of the application that you wish to update

- Select "Contact Administrator" to send the Fund Administrator a message.

- Type out your message and attach (Browse, select and upload) a copy of the signed CHANGE BANK DETAILS FORM

Notification of the request will be sent to the Fund Administrator.

Please contact the Fund Administrator if you have any questions relating to your request.

Direct Debit Savings Plan

A direct debit savings plan is available for investors in this fund.

Do not complete this form if you are planning to borrow money to invest in the Fund from a margin-lending provider.

Direct debit request service agreement

The following is your Direct Debit Service Agreement with the fund administrator. The agreement is designed to explain what your obligations are when undertaking a Direct Debit arrangement with us. It also details what our obligations are to you as your Direct Debit Provider. We recommend you keep this agreement in a safe place for future reference. It forms part of the terms and conditions of your Direct Debit Request (DDR) and should be read in conjunction with your DDR form.

Definitions

account means the account held at your financial institution from which we are authorised to arrange for funds to be debited.

agreement means this Direct Debit Request Service Agreement between you and us.

banking day means a day other than a Saturday or a Sunday or a public holiday listed throughout Australia.

debit day means the day that payment by you to us is due.

debit payment means a particular transaction where a debit is made.

Direct Debit Request means the Direct Debit Request between us and you.

us or we means the Fund Administrator, (the Debit User) you have authorised by signing a Direct Debit Request.

you means the customer who has signed or authorised by other means the Direct Debit Request.

your financial institution means the financial institution nominated by you on the DDR at which the account is maintained.

1. Debiting your account

(1.1) By signing a Direct Debit Request or by providing us with a valid instruction, you have authorised us to arrange for funds to be debited from your account. You should refer to the Direct Debit Request and this agreement for the terms of the arrangement between us and you.

(1.2) We will only arrange for funds to be debited from your account as authorised in the Direct Debit Request. or We will only arrange for funds to be debited from your account if we have sent to the address nominated by you in the Direct Debit Request, a billing advice which specifies the amount payable by you to us and when it is due.

(1.3) If the debit day falls on a day that is not a banking day, we may direct your financial institution to debit your account on the following banking day. If you are unsure about which day your account has or will be debited, you should ask your financial institution.

2. Amendments by us

We may vary any details of this agreement or a Direct Debit Request at any time by giving you at least fourteen (14) days written notice.

3 Amendments by you

You may change, stop or defer a debit payment, or terminate this agreement by providing us with at least fourteen (14 days) notification by writing to the Fund Administrator.

4 Your obligations

(4.1) It is your responsibility to ensure that there are sufficient clear funds available in your account to allow a debit payment to be made in accordance with the Direct Debit Request.

(4.2) If there are insufficient clear funds in your account to meet a debit payment:

(b) you must be arrange for the debit payment to be made by another method or for sufficient clear funds to be in your account by an agreed time so that we can process the debit payment.

(4.3) You should check your account statement to verify that the 5 amounts debited from your account are correct

(4.4) If the Fund Administrator is liable to pay goods and services tax (GST) on a supply made in connection with this agreement, then you agree to pay the fund Administrator on demand an amount equal to the consideration payable for the supply multiplied by the prevailing GST rate.

5 Dispute

(5.1) If you believe that there has been an error in debiting your account, you should notify the Fund Administrator directly and confirm that notice in writing with us as soon as possible, so that we can resolve your query more quickly. Alternatively, you can take it up with your financial institution direct.

(5.2) If we conclude as a result of our investigations that your account has been incorrectly debited we will respond to your query by arranging for your financial institution to adjust your account (including interest and charges) accordingly. We will also notify you in writing of the amount by which your account has been adjusted.

(5.3) If we conclude as a result of our investigations that your account has not been incorrectly debited, we will respond to your query by providing you with reasons and any evidence for this finding in writing.

6. You should check:

(a) with your financial institution whether direct debiting is available from your account as direct debiting is not available;

(b) your account details which you have provided to us are correct by checking them against a recent account statement; and

(c) with your financial institution before completing the Direct Debit Request if you have any queries about how to complete the Direct Debit Request.

7. Confidentiality

(7.1) We will keep any information (including your account details) in your Direct Debit Request confidential. We will make reasonable efforts to keep any such information that we have about you secure, and to ensure that any of our employees or agents who have access to information about you do not make any unauthorised use, modification, reproduction or disclosure of that information.

(7.2) We will only disclose information that we have about you.

(b) for the purposes of this agreement (including disclosing information in connection with any query or claim).

8. Notice

(8.1) If you wish to notify us in writing about anything relating to this agreement, you should write to the Fund Administrator.

(8.2) We will notify you by sending a notice in the ordinary post to the address you have given us in the Direct Debit Request.

(8.3) Any notice will be deemed to have been received on the third banking day after posting.

Please ensure that all data is entered into the system carefully and check each page before you proceed to the next.

Data may only be changed prior in the data collection module, after that it will be locked. If you have made an error, you can delete any application that has not been submitted and start a new application, or contact the Administrator (using the button on the Applications Dashboard) and advise them of the error.

Data Collection Module

As you are filling out the data collection module, you can select the PREVIOUS PAGE button at the bottom of each page to go back and check or change information.

Alternatively, from the Applications Dashboard, you can select "Show details" for the application that you would like to change:

From there, you can either select the "In Progress/Complete" icon, or "Continue Application". This will take you back to the beginning of the application form.

You may use the breadcrumbs at the top of the form to take you directly to a particular section, or use the "Next page" buttons to move through the form and check all the fields.

If at any stage of the process, you need assistance, please do not hesitate to call The SILC Group on +61 3 9600 2828.

As you proceed through the application form, all data collected will be saved.

The next time that the Investors apply for any of the Funds that are available through the system, they will be given the option to pre-populate the new application with data from any of the previous applications, thereby saving time in completing the form and eliminating key-stroke errors.

The application amount and execution pages will not be pre-populated, these fields will need to be completed and terms accepted for the new application.

A charitable trust is a trust for a purpose, not for a person.

Most charitable trusts fall under the following categories:

- the advancement of health, which includes the prevention and relief of sickness, disease or of human suffering;

- the advancement of education;

- the advancement of social and community welfare, which includes the prevention and relief of poverty, distress or disadvantage of individuals or families; the care, support and protection of the aged and people with a disability; the care, support and protection of children and young people; the promotion of community development to enhance social and economic participation; and the care and support of members or former members of the armed forces and the civil defence forces and their families

- the advancement of religion;

- the advancement of culture, which includes the promotion and fostering of culture and the care, preservation and protection of the Australian heritage;

- the advancement of the natural environment; and

- other purposes beneficial to the community, which without limitation include the promotion and protection of civil and human rights; and the prevention and relief of suffering of animals.

The term family trust refers to a discretionary trust set up to hold a family's assets or to conduct a family business. Generally, they are established for asset protection or tax purposes.

An Australian family trust:

- is generally established by a family member for the benefit of members of the 'family group';

- can be the subject of a family trust election which provides it with certain tax advantages, provided that the trust passes the family control test and makes distributions of trust income only to beneficiaries of the trust who are within the 'family group';

- can assist in protecting the family group's assets from the liabilities of one or more of the family members (for instance, in the event of a family member's bankruptcy or insolvency);

- provides a mechanism to pass family assets to future generations; and

- can provide a means of accessing favourable taxation treatment by ensuring all family members use their income tax "tax-free thresholds".

A family trust has many other potential benefits, including avoiding issues such as challenges to the will following a death of a senior member of the family.

The terms and conditions under which a family trust is established and maintained are set out in its deed.

A Registered Managed Investment Scheme (RMIS) is a scheme registered with ASIC to which people make contributions and in return acquire rights to benefits produced by the scheme, where the contributions are to be pooled, or used in a common enterprise, to produce financial benefits for the people who hold interests in the scheme.

ASIC sets out the following definition of a Managed Investment Scheme:

Managed investment schemes are also known as 'managed funds', 'pooled investments' or 'collective investments'. Generally in a managed investment scheme:

- people are brought together to contribute money to get an interest in the scheme ('interests' in a scheme are a type of 'financial product' and are regulated by the Corporations Act 2001)

- money is pooled together with other investors (often many hundreds or thousands of investors) or used in a common enterprise

- a 'responsible entity' operates the scheme. Investors do not have day to day control over the operation of the scheme.

Managed investment schemes cover a wide variety of investments. Some of the popular managed investment schemes that may be offered include:

- cash management trusts

- property trusts

- Australian equity (share) trusts

- many agricultural schemes (eg horticulture, aquaculture, commercial horse breeding)

- international equity trusts

- some film schemes

- timeshare schemes

- some mortgage schemes

- actively managed strata title schemes.

Proof of Identity documents will need to be provided and can be downloaded for a registered scheme, regulated trust or government superannuation fund after conducting a search of the ASIC, ATO or relevant regulator's website (www.abn.buslness.gov.au).

A Regulated Trust is a trust domiciled in either Australia or a foreign country that is regulated by a relevant regulatory body.

This includes:

- Regulated trusts – a trust that is registered and subject to the regulatory oversight of a Commonwealth statutory regulator in relation to its activities as a trust,

- Government Super fund – a trust that is a superannuation fund for Government employees established by legislation.

- Registered Managed Investment Schemes

Proof of Identity documents will need to be provided and can be downloaded for a registered scheme, regulated trust or government superannuation fund after conducting a search of the ASIC, ATO or relevant regulator's website (www.abn.buslness.gov.au).

Like other superannuation (super) funds, self-managed super funds (SMSFs) are a way of saving for retirement. The difference between an SMSF and other types of funds is that, generally, the members of an SMSF are also the trustees. This means the members of the SMSF run it for their own benefit.

When establishing a SMSF, you become a trustee of the fund (or a director of a company that is a trustee). In either case, you will be responsible for managing it according to its trust deed and the laws and rules that apply to SMSFs. The key principle is that you run your SMSF for the sole purpose of providing retirement benefits to members.

The Trustee of the SMSF needs to manage the fund’s investments in the best interests of fund members and in accordance with the law. The SMSF's investments must be separate from the personal and business affairs of fund members, including the Trustee.

The ATO is the regulator of SMSFs. Information on the management of SMSFs are on the ATO website.

The Anti-Money Laundering and Counter-Terrorism Financing Act 2006 ("AML Act") and other applicable anti- money laundering and counter terrorism laws, regulations, rules and policies which apply to the Responsible Entity ("AML Requirements"), regulate financial services and transactions in a way that is designed to detect and prevent money laundering and terrorism financing. The AML Act is enforced by the Australian Transaction Reports and Analysis Centre ("AUSTRAC").

In order to comply with the AML Requirements, the Trustee/Responsible Entity and the Administrator (the "Entities") are required to, amongst other things

- verify your identity and source of your application monies before providing services to you, and to re- identify you if they consider it necessary to do so; and

- where you supply documentation relating to the verification of your identity, keep a record of this documentation for 7 years.

The Entities reserve the right to request such information as is necessary to verify the identity of an applicant and the source of the payment. In the event of delay or failure by the investor to produce this information, the Entities may refuse to accept an application and the application monies relating to such application or may suspend the payment of withdrawal proceeds if necessary to comply with AML Requirements applicable to them. Neither the Entities nor their delegates shall be liable to the Applicant for any loss suffered by the Applicant as a result of the rejection or delay of any subscription or payment of withdrawal proceeds.

The Entities have implemented a number of measures and controls to ensure they comply with their obligations under the AML Requirements, including carefully identifying and monitoring investors. As a result of the implementation of these measures and controls:

- transactions may be delayed, blocked, frozen or refused where an Entity has reasonable grounds to believe that the transaction breaches the law or sanctions of Australia or any other country, including the AML Requirements;

- where transactions are delayed, blocked, frozen or refused the Entities are not liable for any loss you suffer (including consequential loss) caused by reason of any action taken or not taken by them as contemplated above, or as a result of their compliance with the AML Requirements as they apply to the Fund; and

- an Entity may from time to time require additional information from you to assist it in this process.

The Entities have certain reporting obligations under the AML Requirements and are prevented from informing you that any such reporting has taken place. Where required by law, an entity may disclose the information gathered to regulatory or law enforcement agencies, including AUSTRAC.

The Entities are not liable for any loss you may suffer as a result of any compliance with the AML Requirements.

Certified copy means a document that has been certified as a true copy of an original document.

Certified extract means an extract that has been certified as a true copy of some of the information contained in a complete original document by one of the persons described in the sub-paragraphs below.

People who can certify documents or extracts are:

a lawyer - a person who is enrolled on the roll of the Supreme Court of a State or Territory, or High Court of Australia, as a legal practitioner (however described);

a judge of a court;

a magistrate;

a chief executive officer of a Commonwealth court;

a registrar or deputy registrar of a court;

a Justice of the Peace;

a notary public (for the purposes of the Statutory Declaration Regulations 2018);

a police officer;

a postal agent - an agent of the Australian Postal Corporation who is in charge of an office supplying postal services to the public;

the post office - a permanent employee of The Australian Postal Corporation with 2 or more years of continuous service who is employed in an office supplying postal services to the public;

an Australian consular officer or an Australian diplomatic officer (within the meaning of the Consular Fees Act 1955);

an officer with 2 or more continuous years of service with one or more financial institutions (for the purposes of the Statutory Declaration Regulations 2018);

a finance company officer with 2 or more continuous years of service with one or more financial companies (for the purposes of the Statutory Declaration Regulations 2018);

an officer with, or authorised representative of, a holder of an Australian Financial Services Licence, having 2 or more continuous years of service with one or more licensees; and

an accountant - a member of the institute of Chartered Accountants in Australia, CPA Australia or the National Institute of Accountants with 2 or more years of continuous membership.

The Proof of identity module in The SILC Group has 2 stages.

The first stage is an On-Line Investor Verification procedure.

If the Fund's Administrator or Responsible Entity or Trustee has elected to use the online identification verification procedure, all investors will be given the option to verify their identity online (Electronic Verification), or providing the required details online and providing documents in the mail.

The Electronic Verification system will incorporate the data (name, DOB, address, phone number) that has already been entered in the application form, and will conduct a background check through the White Pages, Electoral Roll and other databases. Investors will be asked for details of documents such as a drivers licence or passport, and will usually receive a confirmation before proceeding to the second stage (Supply of documents) and then the submission module.

Investors who do not pass the On-Line Investor Verification procedure will be normally be required to send certified copies of proof of identity documents via post to the Fund's Administrator.

Proof of identity may be required for all persons and entities named in the application form.

All investors will be asked to provide original certified copies of certain forms of identification, as selected in the data collection module.

Forms of identification may include Trust Deeds, Company Registration, Partnership Documents, or may be as simple as Drivers Licence or Passport.

Depending on the requirements of the Fund Manager and Administrator, documents may be uploaded via our secure server in Stage 2 of the Proof of Identity module, or may be asked to post to the Fund Administrator. Details will be provided on the checklist at the conclusion of the application form.

For investors who are retail clients (as defined in the Corporations Act 2001) a 14 day cooling off period applies, during which time, investors may change their mind about investing in the Fund and request that application money be returned. The 14 day cooling off period commences on whichever is the earlier out of:

1. confirmation of the application form being received; or

2. the fifth Business Day after the day when the Units were issued.

Cooling off rights do not apply to Wholesale Clients or where units are issued to investors as a result of distribution reinvestments.

A retail client may exercise his/her cooling off rights by notifying the Fund Administrator in writing.

A retail client is entitled to the return of his/her application money adjusted for any transaction costs and any increase or decrease in the value of their investment incurred as a result of the application for, and termination of, the investment. Any contribution fees or taxes will be refunded.

All investors are advised to refer to the offer documents for the fund in which you have invested and follow the instructions provided if you wish to exercise your cooling off rights.

- the electronic communication provides a method that is used to identify the person and indicate the person's intention in respect of the information communicated;

- also that the method used is reliable as appropriate for the purpose for which the electronic communication was generated or communicated, in the light of all the circumstances, including any relevant agreement; or proven in fact to have fulfilled the functions described either by itself or together with further evidence.

Changes to the Electronic Transactions (Victoria) Act 2000 mean that deeds can now be considered as transactions. They can be in electronic form and "signed, sealed and delivered" by electronic communication, under Victorian law.

Refer: Electronic Transactions (Victoria) Act 2000

Please refer to the Fund's offer documents for processing and cut-off times.

Applications will not be considered complete until all documents and payment have been received by the Fund's Administrator, Proof of Identity confirmed and the appropriate anti-money laundering checks have been finalised.

Please ensure that you have read and understood the offer documents, and in particular the terms and conditions surrounding the deadlines for accepting applications and cleared funds. Most Trustees and Responsible Entities do not accept responsibility for any loss caused as a result of non-receipt, missed deadlines or non-acceptance of any application or cleared funds.

Applications may also be accepted or rejected at the discretion of the Trustee/Responsible Entity.

Unfortunately not all Fund Administrators are equipped to receive online applications at this time.

ON-LINE Proof of Identity is a module that may be turned off by the Fund's Administrator. Depending on the fund that you are applying for, this module may therefore not be available to you. If this is the case, you will be required to post certified copies of all identification documents to the Fund's Administrator.

In the interim period, while these funds are updating their procedures and systems to integrate with Olivia123 they have asked that all Investors send a printed and signed copy (wet signature) of the application form with certified copies of Proof of Identity documents.

As the Fund Administrators change their internal processes, the options of Olivia123 for those funds will update. It is envisaged that all funds will eventually have paperless applications.

Regardless of the above, all Fund Administrators will receive an electronic copy of the application form, and error-free data.

At the conclusion of the Proof of Identity module, investors will submit a digital copy of the application.

Submitting the application will send notification of the application to the Fund Manager and the Fund Administrator, who will be able to access the application for processing via their appropriate systems.

Following online submission, all investors will be given a checklist of next steps that will provide further instruction on where to send any necessary paperwork and proof of payment.

All applications in progress, completed and/or submitted can be viewed at any time.